Quote: Focus on all four factors of your Net-worth simultaneously to grow it! Increase Earnings, Increase Savings, Focus on the Higher rate of Return and Reduce your Cost of Living by simplifying your Lifestyle

What is Net-Worth?

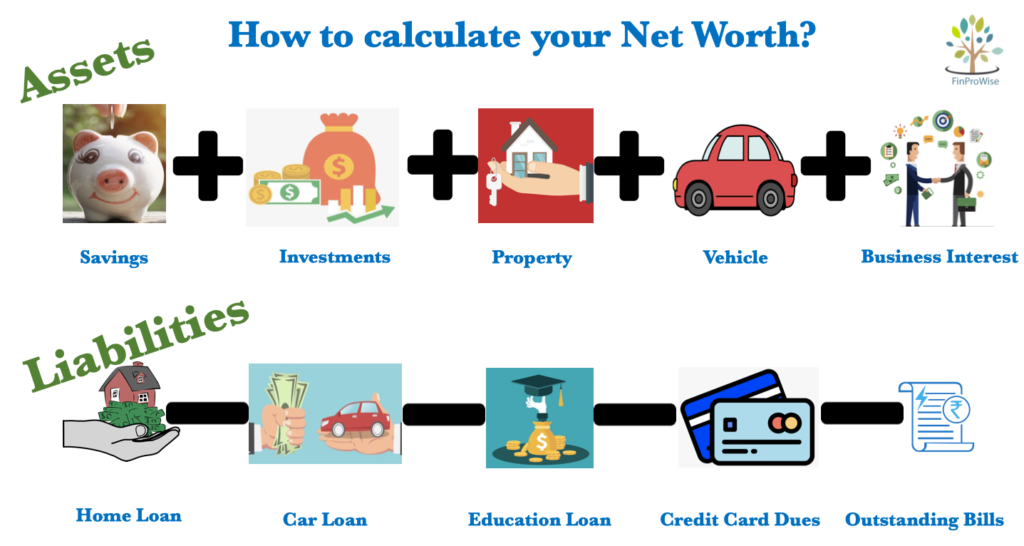

Net Worth is nothing but Assets – Liabilities. However, not everyone is completely aware of his own net worth and unable to calculate the same ONLY because he would not be 100% aware of WHAT assets and liabilities to include while calculating net worth! This is the MOST IMPORTANT factor in calculating net worth.

Net worth helps you gauge your overall financial health and economic status.

How to calculate your Assets?

In calculating your own net worth, you need to value your assets, which includes your savings and investments. The factors which add up to your assets can be listed as:

- The total value of your Savings and Current Accounts

- The total value of your Investments which could be:

- Deposits- Bank, Post office, Corporate, etc.

- Bonds, Derivatives, etc.

- The market value of your Mutual Fund investment

- Stock investment

- Currency and Commodity investment valuation

- Jewellery and Gold Investment

- Art

- Market Valuation of your Vehicles

- Personal Property like jewellery, art, furniture, vintage collection of coins or stamps, etc.

- The market value of your property (other than the current house in which your family stays, as that cannot be liquidated. Hence 2nd property onwards is included in Net Worth)

- Cash or surrender value of Your Insurance Policies

- The market valuation of all your Business Interests

- Accounts receivable

- Inventory

- Raw materials

- Valuation of Fixed Assets

- Lease or rental income

Assets could be earned, inherited or received as a gift. However, all such money needs to be considered.

How to calculate your Liabilities?

In calculating your own net worth, you need to know your total outstanding liabilities which needs to be subtracted from Assets to calculate your net worth.

- Outstanding Property Mortgage Amount

- Outstanding loans like:

- Car Loan,

- Home Loan,

- Personal Loan,

- Education Loan, etc.

- Outstanding Credit Card Dues

- Outstanding Business Debts like:

- Accrued expenses

- Accounts payable

- Unearned revenues

- Cash advances received

- Cash dividends payable

- Outstanding bills/payments

- Outstanding Income Tax

- Other Liabilities

Net Worth = Total Assets – Total Liabilities

In calculating your own net worth, you need to know your total outstanding Liabilities which need to be subtracted from Assets to calculate your net worth.

In calculating your own net worth, you need to know your total outstanding Liabilities which need to be subtracted from Assets to calculate your net worth.

If your net worth is positive, then your Assets are more than your Liabilities. If it is negative, then your Assets are less than your Liabilities. Effective Financial Planning can be done only when you have a clear estimate of your Assets and your Liabilities and thus calculate your Net Worth accordingly.

So, what are you waiting for? Have you calculated your Net Worth yet?

Featured Image Credits: <a href=”https://www.freepik.com/free-photo/business-man-counting-dollar-banknote-online-business-concept_3805663.htm#query=net%20worth&position=12&from_view=search&track=sph”>Image by jcomp</a> on Freepik