All you need to know about Financial planning

Financial Planning sounds like a very difficult concept, but trust me, it a very easy concept. And more often than not, most of the aspects are already in your subconscious mind. Financial Planning is the process of documentation of ALL your possible Financial Requirements in a planned and systematic manner!

We all have dreams and aspirations and work hard towards the same and most dreams and aspirations need a financial commitment. Fulfilling THIS commitment becomes our financial goal.

Financial planning is a well-planned and systematic approach towards providing for the financial goals that would, in turn, help individuals fulfil their dream and live happily fulfilling them. This is the first step taken towards #FinancialFreedom!

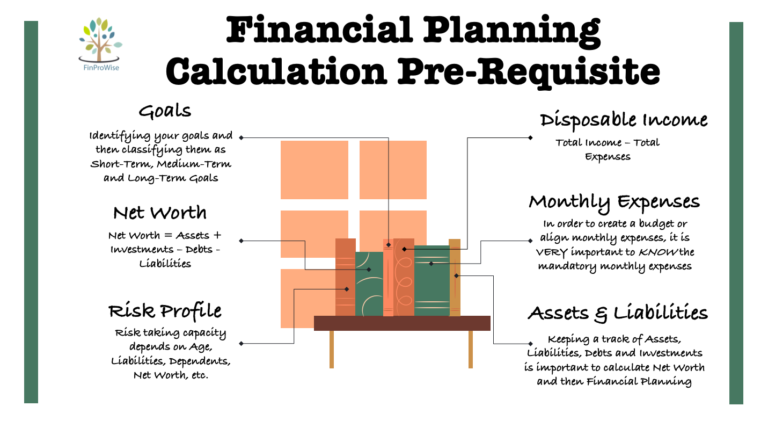

Before you step into a systematic #FinancialPlanning, you need to have a basic clarity of certain #FinancialAspects.

#FinancialPlanningPre-Requisites:

- Goals: Do you know what your #FinancialGoals are?

Let me explain. Suppose you have a goal of buying a car. Do you know what car you wish to buy and when? Quantifying this in rupees can become your #FinancialGoal. So, your goals can be further divided into:- Short-term: like buying a car, international vacation, etc.

- Medium-term: like buying a house, etc.

- Long-term: like retirement, children education, etc.

- Net Worth: In order to know your Net-Worth, you need to know your #Assets, #Liabilities, #Debts and #Investments and then calculate your current Net Worth by using the formulae:

Net Worth = (Assets + Investments) – (Debts + Liabilities) - Disposable Income: is your Income that remains after your expenses are met, for investment, savings, splurging, etc.

Disposable Income = Net Income – Expenses, where Net Income is Gross Income – Taxes - Risk Profile: is your risk-taking capacity, which is a function of your age, investment experience, net worth, assets and liabilities, number of dependents in your family, disposable income, etc. All these factors contribute to your Risk Profile and that must be considered with utmost care before #FinancialPlanning.

- Monthly Expenses: It is very important to know the approximate Monthly Expenses in order to calculate the Disposable Income and then proceed towards a systematic #FinancialPlanning!

- Assets & Liabilities: Knowing your Assets and Liabilities along with Income, Taxes and Investment is the mandatory pre-requisite towards a proper #FinancialPlanning as that consist of the first step towards the same!

#FinancialPlanning is a process of planning the #FinancialFreedom which then needs to be followed and then systematically reviewed and updated since goals and requirements are ever-evolving and subject to change at any point of time!

The 9 #KeySteps of #FinancialPlanning are:

The 9 #KeySteps of #FinancialPlanning are:

Step #1: Emergency Fund

Creating an Emergency Fund is the First Step towards a systematic #Financial Planning.

Emergency Fund = Monthly Income * 6 times is an approximate amount, i.e. 6 month’s income.

Step #2: Set up a Monthly “Budget”

Income – Investment = Budget

and not the other way around!

Step #3: Plan your Insurance

Planning your insurance requirement is important. Life Coverage, Health Insurance Requirement, etc. before wealth accumulation!

Life Coverage= Annual Income * 10 times is an approximate amount.

Step #4: Plan your expected Health Care Expenses

Medical expenses, if not planned properly, can create a dent in your wallet and disrupt the #FinancialPlanning. This is why Health Insurance and medical expenses need to be planned well in advance!

Step #5: Setting off Debt

Debt can push you into a Trap if not repaid on time as the interest compounds!

Step #6: Income Tax

Never ignore or delay your taxes. Rules and slabs might change year-on-year but taxes will be an integral part of your #FinancialPortfolio.

So, remember to pay your taxes on time so that it does not accumulate!

Step #7: Monthly Cash Flow

This is the most important part of #FinancialPlanning. The Monthly Cash Flow is the crux of your #Financial Planning. Planning your Monthly Cash Flow is important, but keeping in mind your:

-

- Investments (and their expected Rate of Interest)

- Assets (and their expected Rate of Growth),

- Liabilities (and when the same can be a set-off with systematic payment),

- Taxes (and the relevant slabs),

- Budget (mandatory Monthly expenses for the household to function),

- Inflation and

- Growing Lifestyle Expenses

Step #8: Do your Retirement Planning

Even if retirement seems like a distant possibility, it is VERY important to start planning your retirement AS SOON AS possible. This is because Retirement is that devil who is in the room but no one sees it as “Inflation” works like a reverse binocular!

Step #9: Review and Monitor

#FinancialPlanning without reviewing the same and monitoring it whether your investments and assets are growing as per your #FinancialGoals is the last but the MOST crucial steps towards the fulfilment of the #FinancialPlanning.

A #FinancialPlan becomes irrelevant if the same is not followed to the tee and not reviewed on time to check its viability and progress!

Written by Rupanjali

Founder, Finprowise Solutions!

Featured Image Credits: Image by rawpixel.com on Freepik